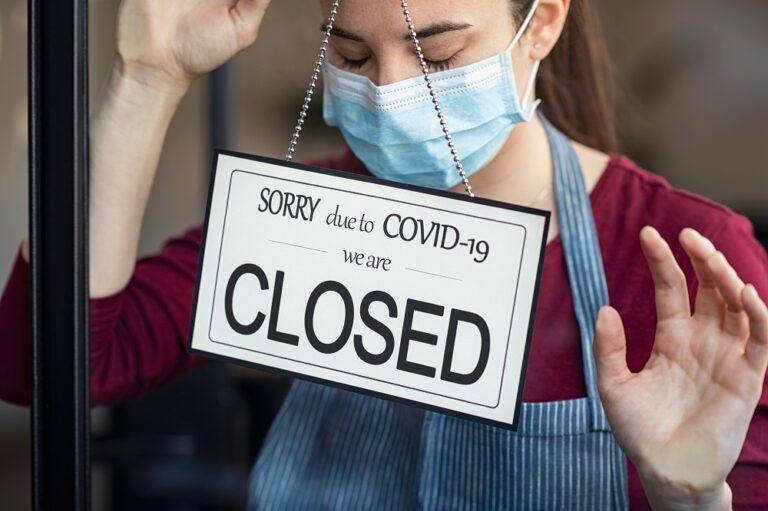

Aim To Have 3 Months’ Worth of Expenses Saved in an Emergency Fund

2020 has proven to everyone how important it is to have an emergency fund. Estimates vary, but a good rule of thumb is to have at least 3 months’ worth of expenses saved up. If you can handle setting aside more than that, even better. Some experts say that you should focus on no less than 9 months!

No matter which estimates you go for, one thing’s for certain. Not having an emergency fund could be devastating to your future finances, since you’ll likely need to dip into your savings otherwise, setting you back months or even years in some cases.

Start Investing Now

Ah, investing, possibly the most daunting aspect of financial security out there!

But should millennials truly fear investing as much as they are? If you’re smart about your choices and diversify your portfolio, you could be looking at 30 to 40 years of compound interest that will undoubtedly set you up for a comfortable retirement.

. Start with as little as $50 per month to get your foot in the water. Eventually, if you invest $6,000 every year, you’ll be looking at $1.86 million 40 years later, provided you’ll have an 8% annual average return. Not too shabby, right?

If you’re unsure of where to start, having a discussion with a financial adviser can help point you in the right direction!